How American Rescue Plan Funds Are Driving Local Innovation in Ohio Cities

October 26, 2023

As we enter the last four months of 2023, memories of the COVID-19 pandemic-era lockdowns and their economic devastation are starting to fade. Indeed, unprecedented job creation, along with steady economic and wage growth, have dominated 2023. The impacts, both personal and economic, of the pandemic, however, continue to impact cities and city residents. Inequalities exacerbated by the pandemic disproportionately harm people of color, families in low-income neighborhoods, and workers in first responder and other frontline professions. The federal government, led by the Biden administration, created the State and Local Fiscal Recovery Fund as part of the American Rescue Plan in March 2021, seeking to ensure that cities and local governments across the country would have the resources necessary to recover quickly and equitably. Ohio cities are taking advantage of this once-in-a-generation opportunity to use an infusion of federal resources to transform their cities for the better.

During the year between March 2022 and March 2023, cities in the Ohio Mayors Alliance (OMA), a bipartisan coalition of 30 of Ohio’s largest cities and suburbs, greatly stepped up their use of fiscal recovery funds after a slow start in the first year of implementation. As of March 31, 2023, OMA’s 30 cities had obligated over half of their total allocation of fiscal recovery funds, and had spent 72 percent of those obligated funds. In the project details and plans, we can finally start to see a glimpse of how those funds have driven innovation and allowed cities to accelerate plans for revitalization and development that were mere dreams before the devastating impact of the pandemic brought them into urgent focus and the American Rescue Plan made them feasible.

This report summarizes overall fiscal recovery fund data reported to the U.S. Department of Treasury by our cities, and highlights some of the interesting, novel, or innovative ways that our cities are allocating and spending these funds. The State and Local Fiscal Recovery Fund was broadly intended to support state and local governments’ responses to and recovery from the COVID-19 pandemic. In particular, the funds were intended to “build a strong, resilient, and equitable recovery by making investments that support long-term growth and opportunity.” In many cases, recovery funds went directly to pandemic recovery like public health initiatives or emergency loans and grants to struggling businesses and communities. In many other cases, funds supported essential city services, in the form of replacement revenue, like public safety, infrastructure, and payroll. In our 2022 report on how OMA cities were spending their American Rescue Plan (ARPA) money, we highlighted and dove into some of those essential uses. You can read that report at www.ohiomayorsalliance.org/publications. In this report, in contrast, we seek to lift up and share the ways our cities are making investments in projects, programs, and initiatives that support long-term growth, build opportunity, and create more resilient, equitable communities.

Data in this report comes from the reports OMA cities sent to the U.S. Department of Treasury, reporting cumulative obligations and expenditures of fiscal recovery fund money as of March 31, 2023.

The Big Picture

OMA’s 30 cities were allocated almost $2 billion in fiscal recovery funds in March 2021. As of March 31, 2023, two years later, they have obligated 55 percent of those funds. Included in that number are some projects that were planned for and then abandoned due to changing priorities or needs, as well as some big projects that are still planned but have not yet begun. Under U.S. Treasury rules, cities must allocate all of their money by the end of 2024, and spend it all by the end of 2026.

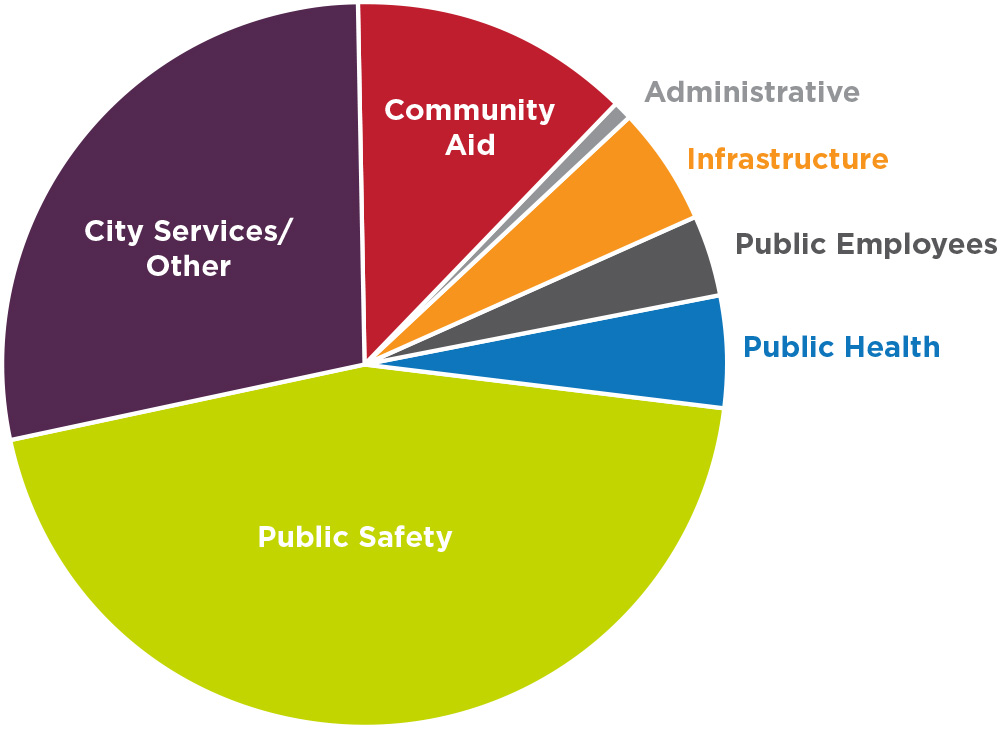

OMA cities have obligated a little over $1 billion in American Rescue Plan fiscal recovery funds. Those obligations break down into the following categories:

The largest single category of expenditures is public safety, which tracks with OMA data showing that cities spend, on average, over half of their total city revenue generally on public safety expenses. Funds obligated in the public safety category include equipment purchases, including police cruisers, firearms and accessories, fire trucks, communications technology, and facilities upgrades and renovations. It also includes costs to hire new police officers, an expense that reflects cities’ optimistic view of the likelihood of economic recovery in coming years.

The Community Aid category includes a wide range of investments in local businesses, community non-profits, hunger relief programs, housing aid, and investments in community assets like green space, arts, and youth programming. City services/Other includes everything from trash removal, cybersecurity and network upgrades for public buildings, touchless faucets, and HVAC system upgrades. Infrastructure funds are primarily focused on drinking water and water/sewer system upgrades and repairs, as well as some road and bridge work, engineering plans, and expanding broadband services. The public employees category includes premium pay for first responders and city workers during the pandemic, as well as investments in public sector capacity. These investments are all in line with the fiscal recovery fund’s mission to ensure that Ohio cities recover and rebuild from the pandemic with a focus on repairing harms, resolving inequities, and providing ceaseless city services and neighborhood safety in all communities.